*STOP PRESS* The new second edition of How to Self-publish and Market a Children’s Book is available from Amazon from 21st May 2021, as both an eBook and print book, and in wider stores from early June 2021. Find out more about what’s inside here

Please note that I am not a tax adviser. If you are in any doubt at all please call the IRS direct using the number given or talk to a tax accountant.

If you are a non-US author your royalties from your US book sales will be subject to a 30% withholding tax until or unless you complete the necessary paperwork (or online interview in the case of Amazon) to claim full or part exemption. Do this as soon as you are ready to publish your first book.

The amount of exemption you can claim depends on the tax treaty your country has with the US. If you’re based in the UK the withholding rate is 0%, so you can claim full exemption. (In this case, you then declare the foreign income on your UK personal or company tax return and pay tax on it in the UK.)

- And check your country’s rate here – scroll down to Table 1 and within this section see the 2nd and 4th table and look in the far right-hand column – the withholding rate for royalties come under ‘Copyrights’ (‘Income category 12’.)

The key point to bear in mind is that 30% will be deducted if you don’t act.

Key steps to claim reduced or no US withholding tax

The process for how to claim was been simplified a couple of years ago – albeit the IRS has communicated this very badly, leaving many authors, distributors and bloggers confused! Even the IRS’s own office staff are often confused and unaware of some of these changes!

At-a-glance process

- When making a claim you no longer need to obtain a US tax ID (ITIN or EIN). Instead you can now supply your own country’s tax ID. And, as far as I can see, this applies whether you are self-publishing as an individual (which includes sole traders) or through a company – however see below that I recommend you double check this if you’re a company.

- To make your claim using Amazon, you complete an online tax interview with KDP – and just follow the online instructions – nice and simple. The questions that appear vary very slightly depending whether you’re applying as an individual or a company – and the final output form that you sign online has a different number for each scenario. Most people reading this will be applying as individuals (includes sole traders). But be sure to check and take a screenshot of what rate of withholding tax will be applied – see my note 24 March below for why.

- For other retailers and distributors, at the time of writing you need to download and complete form W8-BEN for individuals (includes sole traders) or form W8-BEN-E if you’re a company/entity. You send this completed form to the retailer/distributor – not the IRS –by post. I provide links to these forms below.

Below I set out the process in more detail. The first section on KDP covers both individuals (including sole traders) and companies. I’ve split out the later section on different retailers as you’ll need separate forms for these.

Here is a video I made that walks you through the online tax interview. (Made for Alliance of Independent Authors’ fringe event at the 2016 London Book Fair. For CreateSpace now read KDP)

24 March 2015 – mini update

There have been reports on the Alliance of Independent Authors’ FB page from some individual sole traders today saying they have received their tax statements from the IRS having used their NI /own tax numbers as directed by Amazon’s process, yet are still finding they have had US tax deducted. I suppose it’s possible that those statements relate to a previous tax/sales period – ie before they had completed the interview – but I can’t be sure. As I recommend in the sections that follow, when doing the tax interview online be sure to check what rate of withholding tax it says it will be taking before you submit your online form. And on the basis of others’ experience this week, be sure to download a copy of the completed form when it gives you the option at the end. And/or take a screenshot of it. So far those who had sent an EIN with the paper form seem to be okay. Watch this space and call the IRS or email Amazon if in doubt!

Tax process if you’re self-publishing with KDP

- Complete their online tax interview in your dashboard (you’ll come across it during set-up, in the sections that relate to royalties and payments).

- The questions are largely self-explanatory so I shan’t go through them all here – however I’ve picked out a couple of useful screenshots along with what to answer.

Where it asks about a Tax Identify Number (TIN)

- If you’re a UK taxpayer and applying as an individual (includes sole traders), enter your National Insurance Number or Unique Taxpayer’s Reference (UTR – found on your tax paperwork)

- If you’re a UK taxpayer and applying as a company, enter your Corporation Tax reference number

- If you’re not based in the UK enter your relevant individual or company tax ID for your country.

- If you’ve already obtained an ITIN or EIN due to confusion with previous instructions you could opt to include that also – by selecting bullet point 3 seen in the screenshot above – but be aware that the IRS no longer gives a sole trader the option to enter an EIN in the screens that follow. So if you’re a sole trader and have an EIN and not an ITIN I’d be inclined to choose bullet 2 and stick with your country’s own tax ID. (Another option would be to go back and identify yourself as a corporation which then also gives you the EIN option – and I have heard of someone doing this – but I’d probably stick with the former suggestion if it were me.)

If you’re applying as an individual (includes sole traders) or company

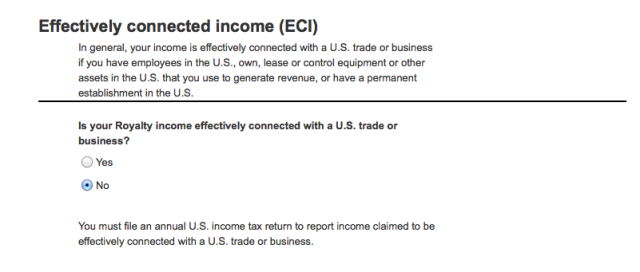

- Answer ‘no’ to the question below – unless of course you have US employees or the other points it mentions are true for you!

If you’re applying as a company

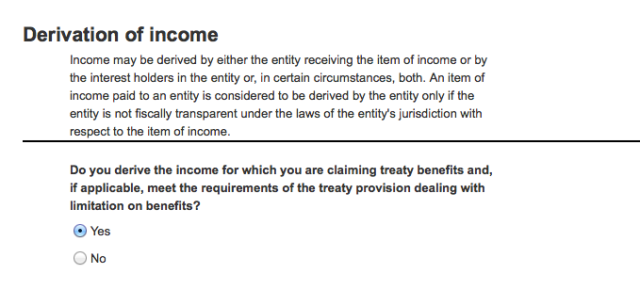

- Answer ‘Yes’ to the question shown below – too complicated to explain why! Chances are an accountant will be doing this for you but if in doubt ask.

The rest of the questions are self-explanatory as far as I can see.

Once they are all completed KDP will generate an online version of form W8-BEN (for individuals) or of form W8-BEN-E (for companies).

- Before submitting, take care to check that you have entered all of the information correctly – and that the correct withholding tax rate for your country is showing (if it’s not abort and start again!).

- Once you submit you’ll get an immediate message telling you what rate of withholding tax – if any – will be applied to your royalty income. For the UK this will show as zero.

What happens next?

- At the start of the interview it asks for your consent to be provided with an electronic version of tax reporting forms each year. (For non-US authors this will be a form 1042-S – a report of your royalties earned from US book sales – the income you need to declare on your own country’s tax return.)

- If you provided your consent they will presumably notify you when the form is ready for you to access online – if you didn’t provide consent, they will send you a hard copy in the post on or after 15th March each year.

- If you’re in the UK, declare this income on your tax return and keep the form for your records in case your tax office asks for it.

- If you’re outside the UK, follow the rules for the country where you live – reading around I gather that in some cases this may mean attaching it to your tax return as evidence of your foreign income.

Tax process with other distributors – for individuals (including sole traders)

It sounds as if other retailers such as Apple, Kobo etc might not be up to date with the fact that you no longer need to supply a US Tax ID – though I gather that Smashwords is now up to speed on this. Feel free to update us all in the comments below if you’ve been through this process recently and know differently. They will probably also still require you to send them a paper form W-8BEN in the post. Assuming this is the case proceed as follows:

- Download and complete form W-8BEN from the IRS website

- Leave question 5 blank where it asks for a US Tax ID* – see below for a suggested note to attach to explain this for any supplier who is not up to date with the new rules.

- At question 6 enter your country’s tax ID (if you’re in the UK this will be your National Insurance number or your Unique Taxpayer’s Reference – found on your tax paperwork).

- At question 10 enter the rate of withholding tax applicable for your country – for the UK this is Zero. If you’re in the UK enter ‘12’ where it says ‘Article number’ – otherwise check which article is relevant for your own country’s treaty with the USA using the links provided earlier. (Easier still, you could leave this blank – I was told to ignore this when completing this form a few years back. In fact, it could be ’12’ for everyone – certainly when playing around with Amazon’s online form it seemed to quote ‘Article 12’ in the final output form whichever country I had input…)

- Where it says ‘Explain the reasons the beneficial owner meets the terms of the treaty article’ I expect you could leave this blank too – I’ve not completed it before. (If you prefer you could say something like ‘Royalties from book sales in the USA’)

- Sign and date the form.

- Send it to the address provided by your retailer/distributor who pays you and has requested it.

* In an accompanying note you could point out that the reason you are not supplying an ITIN is that the rules have changed and explain that Amazon already uses foreign Tax IDs and quote them these instructions from the latest W8-BEN instructions (Feb 2014). “To claim certain treaty benefits, you must complete line 5 by submitting an SSN or ITIN, or line 6 by providing a foreign tax identification number (foreign TIN).”

Tax process with other distributors – if you self-publish as a company

Step 1 – get an EIN (Optional I believe…)

Below I set out how to get an EIN, but as far as I understand it, and based on Amazon’s online interviews, this is now optional. However I recommend you call the IRS on the number below to check this, or ask your accountant! You have nothing to lose by getting an EIN – and it’s quick, free and easy – and it could make life easier for you if dealing with retailers who aren’t up to speed on the new rules.

How to obtain an Employer’s Identification Number (EIN) from the IRS:

- Read the notes on page 2 of the form – these confirm which questions you can miss off since you are only applying to get this EIN for tax withholding purposes. Also see the later section ‘Tips for when completing form SS-4 and calling the IRS ‘

- Complete the form – you can fill the fields in online and then save and print the form.

- Next call the IRS’s dedicated line for businesses that are located outside of the US: 1-267-941-1099 (not toll free). You need to have your completed form SS-4 beside you as they will ask you about your entries. (see the ‘Tips’ section below for how to avoid being asked to fax the form.) NB Since I got my EIN it has become harder to get through and there can be long waiting times so if in the UK try calling at 11am our time – apparently the offices there open at 6am Eastern time and the first hour is the quietest.

- They then give you the number over the phone and say to expect it and relevant paperwork in the post in the next 2-3 weeks. The paperwork arrives as promised.

Step 2 – Download and complete form W8-BEN-E and send it to your retailer/distributor

Again, at the time of writing I believe this has to be done by snail mail with everyone apart from Amazon. Please leave an update in the comments section if this changes and I’ll update this section accordingly.

- Disclaimer – the instructions below are based on my reading of the form & helpnotes. I recommend you check with the IRS or a tax specialist that this is correct. Feel free to leave a comment if you know I have something wrong… 🙂

- In Part I at Questions 1 & 2 enter your company name and country of incorporation

- Ignore question 3

- Tick ‘Corporation’ at Question 4 (for info ‘Chapter 3 Status’ relates to withholding tax for royalties amongst other things)

- Ignore Question 5

- Enter your company’s address at question 6 (ignore 7 unless you have a separate mailing address)

- At Question 8 enter your EIN and/or at question 9b enter your own country’s tax ID (in the UK this will be your corporation tax number)

- Ignore Question 10.

- Ignore Part II

- In Part III at Question 14 tick a and b – and at 14’b’ enter the country where your company is based. Ignore 14c.

- At Question 15 enter the rate of withholding tax agreed for your country in its tax treaty with the USA (for the UK enter ‘zero’ or ‘0’). Specify the type of income as ‘Royalties’.

- At Question 15 where it says “Explain the reasons the beneficial owner meets the terms of the treaty article’, I am guessing you can leave this blank – looking back at my old forms I was told to leave this blank. Call the IRS to check if you want to be absolutely sure (If you don’t want to call or leave it blank I’m sure something along the lines of ‘UK based company earning book royalties that will be declared as foreign income in the UK’ would work!)

- Part IV – through to Part XXVIII– leave blank

- Sign and date etc Part XXIX

- Send this form to your distributors (Smashwords, Apple, etc etc) in line with their instructions that you find when setting up your account. I

- If you choose not to get an EIN and only to provide your company’s tax reference from your own country, I would recommend including a cover letter, again quoting what Amazon does and pointing out that the instructions to this form suggest that you don’t have to provide a US Tax ID.

Tips for when completing form SS-4 and calling the IRS – only applies if you’re self-publishing as a company

- On form SS-4, at question 9a tick ‘Other’ and enter ‘Limited Company (UK)’. The only other possible option at 9a would be to tick ‘corporation’ – which seems to refer to US incorporated companies. The woman at the IRS I spoke to agreed that my approach seemed the best answer.

- When you call, make it clear that you are the owner/director of the business. I say this because when I first called, the woman told me I would need to fax the form while I was on the phone to her (impossible as I only have one phone line…). At that point I had to come off the phone and had planned to call back on my mobile to enable me to fax whoever took the call (it’s a call centre type set-up), but then found it would cost me 72p per minute to do this! So I called from my landline again and the next woman I spoke to said she could do it over the phone without faxing her the form SS-4 because I was the owner of the business.

- Have the date of incorporation of your company to hand. Even though their page 2 instructions said I didn’t need to fill in that info they still asked me for this.

Renewing your tax information every three years – individuals/sole traders and companies

From what I can see there seems to be a requirement to reconfirm details by resubmitting the form every three years. The example the IRS gives is that a Form W-8BEN or W8BEN-E signed on September 30, 2014 remains valid through December 31, 2017.

I think Amazon may get around this using online communication by simply notifying you to check whether your details are up to date and then do nothing if they are (but I may be wrong). Certainly a recent email KDP sent asking me to check whether my tax details were still valid gave this instruction and I left well alone. However I’m not sure how it works with other distributors – the implication is that you’d need to fill in the form and send it all over again. I would suggest you call the IRS to check this if your three-year deadline is approaching. Again, if you know the answer, please leave a comment below.

If you’re a sole trader who previously submitted an EIN…

I have a feeling that where renewals could provide an issue is if you are a sole trader who previoulsy submitted an EIN having followed the IRS’s previous processes.

Logic would suggest that once your three years is up you need to re-complete the Amazon tax interview and/or send in an updated W-8BEN form by post, and provide your own country’s tax ID instead of the EIN.

However, what will happen if you don’t do this I am not sure!

I will try calling the IRS this week to ask – but won’t hold my breath as to whether they will be able to tell me. Internal communication about all of these processes seems to be sorely lacking based on previous experiences – with many IRS offices seeming to be unaware that sole traders and individuals can now provide their own country’s tax ID!

End of update – 22 March 2015. That’s it for now – I am sure I’ll need to make tweaks to this page over the coming days and weeks as/when further comments with updates or corrections come in. And again to remind you that I’m not a tax adviser. If it’s not covered above I probably don’t know the answer!

Getting help: US tax offices based in Europe and China

You can find contact details for IRS offices in the UK, France, Germany or China here. I’ve not yet tried this out, but, according to the IRS website, “The IRS offices listed can answer your federal income tax questions, help with account and refund problems, and assist with the preparation of current and prior year tax returns.”

You can read more about withholding tax on the IRS website here.

UK authors

If you’re a UK author and aren’t sure how to declare you income from books sales, check out my related post on paying UK Income Tax on book royalties

Remember any comments below that pre-date 22 March 2015 pertain to the old content from this page – so best ignore all but the most recent, some of which cover the new process.

I’m filling in a W8BEN for Zazzle and struggling to get the correct phrase for the additional comments on Question 10. (my painting images are used, print on demand, so royalties) Right now, I have “copyright royalties from reproductions of original artworks” which has been rejected for amendment. What’s the correct phrase to use?!

Hi Andrea — I’ve just looked back at my form which is the W8BEN-E (for limited companies) and it only asks for additional info in section 11 and I haven’t added anything in that additional info section. (What I did add in the main body of the paragraph was that I’m claiming under *paragraph 12(1)* of the treaty and claiming *0.0%* rate and that the type of income is *Royalty*. So maybe just leave your comments section blank?

Sorry I can’t be of more help! Below is a copy from section 11 on my form (this was from a few years ago — I don’t know if the numbering of the paragraphs has changed.)

11

Special rates and conditions: (if applicable-see instructions): The beneficial owner is claiming the provisions of Article and paragraph

12(1) of the treaty identified on line 10a above to claim a 0.0% rate of withholding on (specify type of income): Royalty

Explain the additional conditions in the Article the beneficial owner meets to be eligible for the rate of withholding: Article and

paragraph 12(1)

Thanks. I did actually leave the lines blank originally, but it got returned saying I had to fill it in. I have Article 12 para 1 to claim 0% interest filled in, specified “royalties from reproduction of artwork” and then explain additional conditions to be eligible for 0% for which I’ve put “beneficial owner is a permanent resident of UK” This is all part of section 2 question 10 now. There is no section 11 for the W8-BEN.

In that case I’m baffled. I’d suggest trying google to see if you can find others in your boat and what they have done. OR why not just call the IRS helpline? Good luck with it and if you solve it do leave a note here for others’ benefit, in case they run into the same problem! Karen

Hi,

Are you 100% sure royalties are exempt for UK Limited Companies under US-UK treaty?

If you look at Article 12 of the UK-US Tax Treaty it says:

Royalties arising in a Contracting State and beneficially owned by a resident of the other Contracting State shall be taxable only in that other State

Article 1 says:

Except as specifically provided herein, this Convention is applicable only to persons who are residents of one or both of the Contracting States.

I’m no accountant or lawyer but I’m struggling to see how Ltd companies can be exempt in this case…

Hi Ash — yes it’s correct. I’ve been doing this since 2011 as have 1000s of other authors before and after me – some as running their businesses as sole traders and some as ltd companies. The UK has a double taxation treaty with the US and the upshot is you only pay tax in one country. And when I first set this up I called the IRS and spoke to them to be absolutely sure I was getting it right. The same applies for sole traders though the form is slightly different. I have no base in the US and I think that is the key point. If in any doubt do speak to a tax advisor. But if you complete the KDP tax interview you will see that the outcome is you pay no tax in the US and instead pay it all in the UK. If you don’t complete the form, the US withholds 30% tax. Please note that I’m not a tax advisor so best to direct any additional questions to one! 🙂

Hi Karen,

Thank you for this blog and all the valuable information inside it. I’m from the UK and have a Limited Company. I have a few questions I was wondering if you can help me with:

1. I’ve followed through the tax interview process for KDP (as a UK ltd company) as shown in your video. I’ve put in my UTR number and selected “Yes” for the question “Do you derive the income for which you are claiming treaty benefits?”. Now It’s asking me to select an option from “Limitation of benefits” dropdown (Perhaps this is something new as I haven’t seen it in the video). There are several options: Government, Publicly traded corporation, Subsidiary of a publicly traded corporation, Tax exempt pension trust or pension fund, Other tax exempt organization, Company that meets the ownership and base erosion test, Company that meets the derivative benefits test, Company with an item of income that meets active trade or business test, and Favorable discretionary determination by the US competent authority received.

Do you know which one to select?

2. As a UK citizen I’m aware that there’s a 0% withholding rate due to UK/US tax treaty. I’m also aware that I’m/my company is required to pay tax here in the UK only (and not the US). However, I’m confused as to whether I still have to file a tax return with the IRS. Is this something that I’m required to do each year?

3. Is the 1042s form people receive just for information purposes?

4. Some people advice on setting up as an individual even if you have a limited company. Is this a good idea?

Apologies for such a long post 😊

Hi there — gosh — I’m not aware of that dropdown — it must be new… I’d almost guess it might be ‘Company that meet the derivative benefits test’ (as that mix of words rings a bell from the form) but I’m really not sure. (Hmm — actually if you look at the screenshots above there is one that sounds very similar to that so I bet it’s that one…but can’t say for certain!)

Why not try calling the US helpline for the IRS to see if they can help or try googling around to see if others have come up against this. As I have always had an EIN from years back I’ve no idea if that means I see a different dropdown but I suspect not. Otherwise you could try calling HMRC’s Corporation Tax helpline (try early in the day!) — they surely will know?

Sorry I can’t be of more help but do let me know what you find out.

In answer to your other question – you just get that US 1042s form for info and you don’t need to file a return with the IRS as that’s the whole point of the double tax treaty.

As to whether you do this as a ltd company or sole trader it’s up to you. I already had my ltd company and was a professional copywriter / consultant before I began writing children’s books, so it made sense to wrap in my fiction writing with it. As it happens, with the sales I now make it means it does make good sense – with low volume sales it’s probably questionable due to accountancy fees etc. Your accountant is probably the best person to get your answer from, as I assume you have the company already.

BTW you may find that someone else following this thread can answer your question above so look out for other comments. A few tax accountants do follow here I think.

With very best wishes and best of luck – and do let me know the outcome if you get an answer!

Karen

Karen and Clare thank you very much for your help and quick replies. I’m glad there’s no filing to do for the IRS. Would’ve been a nightmare! It’s tough enough to meet the deadlines and demands of a UK Limited Company. I selected “Company that meets the derivative benefits test” from the dropdown menu (as Clare suggested). Tax interview is now complete and withholding rate is 0%. 😁

Hi Amin ( and a wave to Karen), UK tax accountant and author here.

(1) The answer to that part of the KDP Tax Interview is “Company that meets the derivative benefits test”, (2) no you don’t have to file a tax return in the US, because as you have just stated on the form, your trade and income is domiciled in the UK not the US, and (3) the 1042S is purely for information and doesn’t commit you to any reporting in the US. And (4) – as Karen says, that’s up to you. There’s no right/wrong answer, it depends on your overall tax situation, what level of income you’re earning, what you want out of your financial status… all sorts of issues, not all of them quantitative ;). There’s a page on my website where I summarise some of the points people commonly consider when deciding whether to trade as a company or a sole trader https://quidsandquills.com/should-i-incorporate/. And no, I’m not trawling for clients LOL, but I offer a free query to any visitor, so I reckon this is covered by that :). Good luck with it all!

Thanks for letting us know, Elizabeth. Out of interest did you input all this info in the KDP online interview? (I wasn’t sure what you meant when you said you couldn’t access the W8-BEN-E form? From recollection doesn’t that just appear at the end of the interview which is kind of the form all along b/c you had selected to say you are a limited company and you then download it or something (on the basis that it’s the form you’ve just filled in?) Or did it just appear and you couldn’t click it or something? Would be good for clarity when I update the info for others? I’m wondering if the fact you used the UK CT tax UTR caused it to glitch this way, even if it turned out to be okay in the end…

Karen, the W8-BEN-E form popped up at the end like you said it would, but then when I clicked away from that screen and went back to the page with 3 parts (1) your info, 2) where to pay the money and 3) the tax interview), the button under view/ review tax interview just wasn’t active. Once fixed, it was, and I can now see the W8-BEN-E form and also click to edit if I should so wish. My suspicion is that they have to verify their end that the UK CT tax UTR existed/ was legit/ corresponded with the registered limited company. But it has saved me calling the US for an EIN. Although I appreciate I may still have to do this if and when I apply to other distributors. I’ll post you if and when I do. 🙂

Great – thanks for that 🙂

Thank you both for all your helpful advice!

Hi there Karen and Clare, Soooo, decided to use limited company already set up (thank you ref info on VAT on AMS), my freelance activities are already included and book pertains to that, so should be OK, but will double check with accountant. I completed tax info as a business, used the limited company’s UTR and ticked that I derived benefits and in the very last box, why I am able to claim treaty benefits, ticked the box ‘other’ (as none of the options applied). The box wouldn’t take free text, so couldn’t add a justification, like I pay UK corporation tax or similar, so I just crossed my fingers! I then called KDP’s helpline as I now couldn’t access the W8-BEN-E form. Someone in their tax department checked over my form (I was on hold for almost 30 mins, but had requested a call back from them, so at their expense) and said it was all OK and I can now view the form (seems they have to verify the tax interview information their end). So now I can now sit back and wait for the millions to roll in and be reported in the 1042-S form that the system tells me I will receive to declare in UK. 😉 Long and short: if registering as a limited company from the UK, seems the UTR for the limited company suffices in the TIN section without getting an EIN. I’ll re-post if anything comes up to contradict this.

Agree, with the above accountant’s comment. Sorry – I understood Elizabeth’s question re ‘business’ to be framed around Ltd Company and EINs of course. As I say – to solve the “is an EIN still needed if you’re a ltd company?” question it may be worth doing a dummy run to fill out the online tax form and adding a CT number where it asks for an EIN and seeing the message at the end about what rate of tax will be applied (which you can do before you submit it — and thus cancel the whole thing at that point if it shows that 30% will still be withheld). Calling the IRS is probably easy and quick though!

Hi Karen, that accountant is me, Clare London, I didn’t realise I was logged in with my other “hat” on LOLOL

Another query: as Clare London has commented in April 2020 suggesting you should go ahead and get a EIN number if you are a business by calling the US IRS office (I have seen this on other blogs), then I am assuming this is still the case? (That you need to get an EIN number if registering as a business.)

I don’t know is the answer! I’m guessing your Corporation Tax number would suffice in the same way that your NI numberer now works if you’re an individual but as I already have an EIN from years ago I still use it. You could try completing the Amazon online tax interview and entering your CT number I guess then see if at the end the form shows that no tax will be deducted. If that’s the case I think you should be okay. (I’m sorry but I now can’t recall where on the form it asked for the EIN and whether this would make sense? Why not call the IRS and ask if you need one? Or maybe call KDP Helpline and ask if they know?) Sorry I can’t be of more help but I’m guessing the IRS or KDP should have a definitive answer on this by now! Or ask another author who has only recently incorporated what they have done? Feel free to chip in, Clare, if you know more!

Elizabeth, you only need an EIN if you’re trading as a limited company at Amazon (and other distributors). Otherwise you can use your NI number for the “tax reference” when you set up your account at Kindle Direct Publishing (Karen, I don’t think you can use the Corporation Tax number, though I’ve never tried ^_~ ). The word “business” can be misleading – you’re in ‘business’ the minute you publish a book, but you then decide whether to operate that business as an individual (self-employment / sole trader / use your NI number at Amazon’s tax interview) or as a limited company (set up a company / legal commitment to annual returns and accounts / obtain an EIN for Amazon’s tax interview). The decision on what legal status you trade under is yours – you’ll want to consider the tax implications, the legal commitment, the admin work involved, your ‘face’ to the general public etc etc. I’ve got a brief summary on the overall principles here: quidsandquills.com/should-i-incorporate/

Hi there Karen and Clare, wow, I feel like you are providing light in the tunnel. I am debating whether to put my self-publishing endeavours through my husband’s existing limited company, which is necessarily VAT registered (but both hard and e-books are now zero rated), as I have outside employment too, or personally. Pros and cons?

It depends how much you pay in the way of expenses. For me the game changer in recent years has been UK Amazon Advertising costs which are subject to VAT and amount to quite a lot. I re-registered for VAT a couple of years ago to be able to claim back the VAT even though my turnover at that time was below the threshold (it’s now over it). It’s also useful for claiming back on any UK course costs etc Against this there is the pain of having to do the VAT return — including something called reverse charging for EC sales – even for zero rated B2B royalty income. The VAT man also wants you to include all world wide turnover that’s outside the scope of VAT in the return. I think the reverse charging thing will change when we leave the EU at the end of the year but don’t know what the implications of that are for returns — I take it one step at a time! I think it’s best you ask your husband’s accountant and let him know your likely sales and ad spend both here and overseas.

I agree with Karen, Elizabeth! mainly because there’s no “right” answer. You’d need to get an accountant to weigh up the different options and find which is best for you, depending on both your and your husband’s tax position. This is only my personal opinion (!) but I never recommend getting involved with VAT unless you HAVE to register, because it’s a very strict, complex, and administratively burdensome tax. Most authors rarely come up against it in their usual writing business (apart from Amazon, they tend to be individuals dealing with individuals). You should also consider what your husband’s company is set up to do, as per its articles of association – it’s not always appropriate or legal to bunch up several trades under one company name. You can, of course, combine your self-employed business with your employed income on an annual tax return, which is often the way to start. Good luck!

Thanks, Clare! Hope that helps, Kas.

Hi Karen and Clare, thank you so much for your responses! It’s certainly a relief to hear I can at least try claiming sum of the lost amount back. I will first work on sorting out 2018/2019 as you both suggested and then contact HMRC once I’ve got all the information organised for them, it shouldn’t be too difficult as I already have all the data I’ll need. Fingers crossed they are understanding of my mistake! I appreciate you both taking the time out of your busy day to help a complete stranger. At the time of setting everything up with Amazon I was very new to the business word and really struggled to get a handle on those financial forms/understanding self assessment which is probably how I ended up in this mess to begin with, having said that, if it wasn’t for this blog I probably wouldn’t have realised by mistake till much later! Thanks again to you both 🙂

This is a fantastic site! Thank you so much for sharing all of this. Sadly I discovered it a little too late. It seems that I have been paying tax twice for my amazon sales between the UK and US for the last 3 years. I thought by filling in the W-8BEN I was covered but after contacting Amazon they informed me I hadn’t claimed Tax Treaty on my form. I’ve since updated everything but just wondering if there is anything I can do to reclaim the lost amount? I tried speaking to an accountant online but he didn’t seem too familiar with this process.

Hi Kas — sorry to hear that. I don’t believe you can get anything back from the US (or, if you can, it could be a long and complicated process and would probably only apply for the last 12 months). However, I believe that if you contact HMRC you have the right to amend your Self Assessment tax return within 12 months of sending it in (go to GOV. UK and search for ‘amending a tax return’). On that basis, if you paid 30% tax in the US in the period of your last tax return you could show them evidence of this and they may exclude that income from your UK taxable income as you’ve already paid tax on it. (If you’re higher rate tax payer then you may just have 10% to pay etc). I have no idea if that will work but worth a try!

Hi Kas. Yes that will work! The tax you’ve had deducted at source by Amazon can be deducted from your total tax payable on the Self Assessment Return, thereby reducing your overall UK tax bill. At the moment, you can easily amend your 2018/2019 return for this online, though earlier years are closed. But you can write to HMRC about the earlier years, explain that you should have included the “tax deducted at source” and they may re-issue the assessments on those years and send you a refund of UK tax paid. But as Karen says, there’s little to no chance of getting the US tax back directly from the US. You would have to register into the US tax system, and I wouldn’t recommend that for anyone who doesn’t trade directly in the USA.

Hi Andrew, UK accountant with author clients here. The decision as to whether you publish as a sole trader or a limited company is a separate decision, and depends on your preferences and personal tax situation. There are legal ramifications, as you say, and you shouldn’t be operating as both at the same time. If you just use a trading name you are a sole trader, and an Individual in Amazon’s Tax Interview, but if you set up a limited company, you are a legal company and a Business. You are the publisher in either case, and the publisher is the Individual or the Business. The Tax form is actually much simpler than it looks, and you can easily claim the 0% retention. It really makes sense NOT to have US tax deducted, in the first place. After all, if you’re starting out in business, you may not actually have any tax at all to pay in the initial year(s) – but you’ll never get that tax deducted back from the US. Then if you’re an Individual you can use your NI number as your tax number in the interview, and if you’re a company you can obtain an EIN for the sake of a Transatlantic phone call. Both entitle you to the tax exemption. And my personal advice? Consider carefully before incorporating: it’s often better to start as a sole trader, and keep incorporation as an option for later. There’s a lot of extra paperwork and statutory responsibilities. Hope you don’t mind me dropping in, Karen 🙂

No problem — and I agree with all you say. Don’t incorporate unless there are good reasons to. As it happens, I already had a Ltd company for my business writing when I first self-published and thus including my fiction writing was simple. (Way back then it also meant I cold get my EIN over the phone whereas sole traders had to post passports and the like to the US! Of course everything has changed now.)

Hi Karen,

Excellent article! I have a few questions that if you could answer I would greatly appreciate your time doing so.

During the tax interview it requires the selection of “Individual” and “Business”. I guess my issue is, if one functions as an Ltd, they are a business, and by scouring the internet, many authors selecting as a business are required to send IRS tax return forms, as operating as a business is different than an individual.

I guess the workaround is to select “Individual” and function as an Ltd, but I am not sure of the legal ramifications of such a selection while operating differently.

In terms of publishing as a “business”, is this linked to the publisher? Are they one and the same? Or is it separate?

I am nearing publishing, and wondered whether to operate as an Ltd or Sole Proprietor. I still have no idea.

In all honesty, in some senses I feel it is just easier to take the 30% hit for peace of mind that the IRS won’t be ringing me. Looking online, those who did this process wrong ended up with excessive fines – bankruptcy inducing fines. I would rather take the 30% on the nose if I cannot figure out which selections are correct to ensure I don’t need to send yearly tax forms to the IRS.

Apparently things have updated and we need to enter a country specific EIN/ITIN? I am trying to complete the Tax interview and it is asking me for my very own specific number…

Hi Andrew — it’s a bit late so I’ll reply tomorrow! Karen

Hi Andrew – *so sorry* that I forgot to reply to you here the other day. We are in such strange times, and I’m a bit all over the place!

I would select Individual and go the self-employed sole trader route — you are still a business but it’s a far simpler set-up and you are deemed as an individual for these purposes. As a sole trader you can do your taxes yourself via the Self Employment pages of the Self Assessment Tax return.

Only think about incorporating if you’re making huge royalties I would say.

If you follow my video above for the tax interview you will find that it is very straightforward for sole traders — and you simply provide your NI number as your tax reference. You should not be taking the hit on the 30% tax — it’s really not necessary! Even if you’re only making a few sales to start with, your aim is for those to increase so get organised as you mean to continue.

For the record, even if you’re a ltd company you do not need to file any tax returns with the IRS. The whole point about double taxation treaties is that you only pay tax in your own country. But you need to complete the interview in order to make that fall into place.

I hope his makes sense? Leave me another comment is if it’s not clear. You don’t need to employ an accountant if going the sole trader/individual route.

As far as I understand you would have nothing to pay unless your own tax rate is more than 30% in which case I expect you would need to pay the difference . But please remember I am not a tax advisor! Best to check with a local accountant— they will know right away. (You would need to declare that income according to your country’s tax rules but at the same time indicate that 30% tax is already paid.)

If you don’t normally need to complete a ta return due to low income (ie if you don’t normally pay any tax) then you would be losing 30% of your royalty income.

I’d recommend asking a local accountant (where are you based by the way?).

Interesting reading. I don’t know how I got to this page but it’s really interesting. Let me see if I get this straight if Amazon withholds the 30% you don’t have to pay taxes to anyone or any country?And you don’t have to bother with filling out forms?

So sorry for my late reply. The last few comments didn’t get notified to me.

If you do nothing, you have already paid 30% tax to the USA. So if you would pay less tax in your country then it’s worth filling out the forms. Hope that helps!

But if I pay 30% I don’t have to deal with taxes all in any country? It is taken care of?

Hello Karen,

Thank you for your post! I am a non-US citizen and my country of residence does not have a tax treaty with the US. Can I obtain the EIN now to avoid 30% WHT when selling a book on Amazon?

Elsewhere it says that “The EIN appears to no longer be an option on Amazon Kindle for non-U.S. individuals or sole proprietors. The options available to you now are a U.S. TIN (i.e. social insurance number or ITIN) or a foreign (non U.S. income tax identification number).

What should I do now?

Thanks a lot!

Ha

Hello — if you are not a limited company then just use your tax ID from your country. If you watch my video I think it explain this 🙂 The EIN is only for companies — and even then it may not be needed any longer. So sorry for my late reply. The last few comments didn’t get notified to me! Karen

HI Karen, thanks so much for your response. They haven’t mentioned the form but it is a genuine traditional publisher and yes, they cover costs. I will have the contract checked anyways as always. Thank you so much for the time you took to respond. This is such a great post 🙂

HI Karen, I am UK based and it is with a traditional publishing house, not Amazon.

Hi Maria — If you’re based here and they are in the US I think it’s likely to be no different in terms of paperwork than it is for Amazon. You don’t register there for tax purposes because you live here 🙂 The whole point of the form is to prevent the IRS from deducting 30% taxes from your royalties. Instead you declare them on your UK tax return and pay tax on them at your UK rate.

Ultimately their accounts department should be able to confirm this to you (or a small business accountant here) — I’m not a tax adviser I’m afraid!

Out of interest, have they asked you to complete the W8-BEN form? Or do you only know about the form and tax stuff after reading my blog and they’ve not mentioned it yet? I am hoping it will be the former and not the latter!

The reason I ask is if you don’t have an agent — and I’m guessing you don’t as they should know all about this — I just want to be sure this is a genuine deal and they aren’t asking you to pay anything towards the production costs? If they are asking for any money don’t touch it and I’ll send you a link where you can check their credentials. Hopefully that isn’t the case but a lot of authors get scammed by companies pretending to be ‘publishers’ offering them a ‘contract’. If they are a genuine traditional publisher they will cover ALL costs including editing, printing and so on. Fingers crossed this is what you’re being offered. I would definitely get someone to check your contract before you sign though if you haven’t already and you don’t have an agent here in the UK. ALLi can check it if you’re a member, for example.

Hope this helps and apologies for sounding alarmist if this is a genuine deal — and well done if it is 🙂 Karen

Hi Karen,

Huge thanks for this guide. It is the best found all over the internet. Simple and clear. I am about to make a contract with a US publisher (I am sole trader) and from what I understand I will need to fill the W8-BEN form and return it to them. What is not clear to me is, will I need to do any further paperwork with IRS? Will I have to register as US resident for tax purposes since I have income generated in the US (albeit only from royalties)?

Hi Maria — where are you based? And is the contract with a traditional publishing house in the USA? Karen

Pingback: Running Your Author Empire #AuthorToolboxBlogHop | Ronel the Mythmaker

Hi Karen,

Thanks very much for your prompt and detailed response. The clarifications are certainly very useful. I’m only half way through your book, which still is packed with lots of new information – so, thanks for all the pointers. I will most certainly leave a review.

Thanks again

Best wishes

Percy

Dear Karen,

Thanks for your generosity in sharing all this information on your blog.

I also bought you latest book which is packed with so much useful information for self-publishing, which I simply would not have found otherwise. So… thank you! (I also enjoyed reading Eeek! which I bought some time ago and now sits in front of my computer for inspiration, in the hope that my book too would see the light of day! :))

Mine is a children’s chapter book, and I hope to get it published using KDP and Ingram as advised by you. I want to use a Pen name, which seems to add a further layer of complexity to the already slightly confusing process of self-publishing. I would be really grateful for any advise on the following:

I am in the UK and want to publish using a Pen name and as publisher (in case I wanted to publish other books – that’s the dream at least! :)). I hope you could kindly advise whether the following would be the most suitable way to go forward:

1. Register as a sole trader and ‘publisher’ using a company/trade name (such as ‘Well Said Press’ in your case) linked to my actual name for tax purposes. I’m employed and do not submit self-assessment forms.

Do I have to register the publisher name as a ‘trade mark’ as well?

2. Obtain an ISBN from Neilson. I believe I have to use the Company name as Publisher and my Pen name as author here? I’m slightly worried that my actual name wouldn’t appear anywhere on this – is that OK?

3. Upload to KDP and Ingram using my real name and company name for the account and pen name for author?

While writing the book was enjoyable, I find this whole process rather daunting :/.

Thanks very much, once again.

Best wishes

Percy

Hi Percy

I’m glad you’re finding the book useful 🙂 It was lots of work but I’m very pleased with the outcome.

Regarding pen names and Amazon, the articles I give links to below are very useful once you have set up your KDP Account (I have just found them via Google..).

Interestingly I only did this (set up a Pen name) for the first time myself when I brought out the non-fiction book because I didn’t want it listed under my usual name of Karen Inglis — so I put the author down as Karen P Inglis and then had to ‘claim’ the book via Author Central and link to my main account.

From recollection this is what you do at KDP Set up:

1/ At upload you give your own name for account set-up — ie the name to which bills will be issued. In this case it will be your first and last name and you will provide your bank details etc for that, be that your personal bank account or separate bank account you have chosen to set up for your Sole Trader business.** (see note below for more on that…)

2/ When you come to set up your book itself you will then put your Pen name as the author name and where it asks for the name of the publisher (or imprint name — I can’t remember how it words it) you can enter the name of your chosen imprint, whatever you decide on that.

3/ Once your book is published, follow the instructions in these articles to claim your author central profile and link your book to your account:

http://publishingwithkindle.com/working-with-amazon-author-pen-names/

http://publishingwithkindle.com/kindle-published-authors-claim-your-amazon-author-central-profile-url/

I can’t promise the above articles are up to date but from a quick look they seem to be…. if not you can google around or ask in the ALLi FB group if you are a member.

With regard to trade names and companies — you won’t be setting up a limited company. You are simply acting as a sole trader — I genuinely cannot remember if you need to tell your tax office the name of your imprint; I have feeling you don’t need to but you may need to enter it when completing your tax return later on if it asks for your trading name. And you certainly don’t want to be getting into the cost of registering your chosen name as a trademark! If you see page 118 in my book and follow the link to gov.uk you’ll find out more about setting up as a sole trader and there is a number you can call for more help 0300 200 3504 – just be prepared to wait to get through.

**As I write I cannot recall if you must set up a separate bank account for your sole trader business or whether it is optional – I expect it’s the latter but that the former makes more sense! This is the sort of question to ask either the self-employed helpline or a small business tax accountant. As I have a limited company everything was separate from the start so I can’t really compare my situation to yours.

Regards your question re names to use with Nielsen I’ve just doubled check with them (it’s a while since I did this!) and, as I suspected, it would be your own name for contact details and payment purposes and then they will ask for the publisher/imprint name to associate with that ISBN or block of ISBNs. You only give your Pen name when you upload a title. And if you have more than one Pen name that will work also — eg if you publish another book under another Pen name for some reason. The ISBN is tied to the imprint name not the author name when. The Nieslen help desk is very helpful so just give the a call on 01483712215 if you want reassurance!

I hope that helps. I would start by talking to HMRC’s self-employment helpline if you can bear to wait to get through. (You may also find they say you don’t need to register for self assessment until your income reaches a certain level…) Or find a friendly local small business accountant. I am not a tax adviser so please don’t rely on my info other than as a high level guide!

I hope this helps more than it hinders. Oh — it would be fantastic if you could take a moment to leave a review of my book on Amazon — every little helps, as we all know! With many thanks 🙂 Karen

PS you will also see that in my book I mention that Gov.uk has a link that allows you to check if someone has already trademarked a name

Hi Percy — one other thing. It looks as if you won’t need to register as self-employed for tax purposes until you earn more than £1,000 in a tax year — but be sure to keep records of expenses in the meantime. This is new for the 17-18 tax year… The details are on gov. uk but this article offers a good summary https://jf-financial.co.uk/2018/01/01/1000-tax-free-trading-allowance/

Hi, I’ve only just discovered that I’ve been paying the 30% rate for my US sales for the past 5 years. That’s a lot of tax I’ve paid out needlessly! I was wondering if you know of any way to claim a rebate from the US authorities?

Hi – wow — sorry to hear that. I have a feeling you *may* be able to claim for up to six months’ worth but I can’t be sure. And I’m afraid I don’t know the process. I’d start by writing to the IRS to ask, or by looking in CreateSpace or KDP forums to see if anyone has documented what they’ve done there. I’ve certainly seen the question asked but don’t recall seeing a definitive answer. You could also try emailing CreateSpace or KDP help to see if they happen to know I guess? (Or if you know someone who sells in the US who has an accountant the accountant may know…?) Sorry I can’t be of more help!

Just wanted to say thanks. Used your post for help when I originally sorted things in 3/4 years ago and just used it again to work out why amazon wouldn’t accept my EIN when they wanted an update (now used my NI number instead).

Glad it helped 🙂

Karen, I received the following from Amazon a few weeks ago telling me my tax form is expiring and will expire on 1 January. I didn’t think we had to do this, is it new? I’ve been ill for the past few weeks so have put off doing it.. This is what the message says:

Amazon is required to collect tax information for your account to comply with U.S. tax regulations. The U.S. tax form (IRS Form W-8) provided for your account will expire on Monday, January 1, 2018. Please take the tax interview as soon as possible to update your account. Learn more

Complete Tax Information

Just to let you know what happened. I renewed it on 26 and it was updated on the 27 – all very quick and easy to do. Happy New Year:) Carole

I’m so sorry I didn’t see your comment, Carole. My website seems to have stopped notifying me and I’ve been very busy. I hope you solved this problem. In short it just meant you needed to go back and to the same interview as before — it’s all online now and I cover how to do this in the video which is part of this blog post. I hope this helps but also that you found the answer before your deadline. Apologies again. Karen

Margaret — the Amazon / KDP interview will generate the W8 for for you online — my post at the top of this page covers this but I’m pasting the key points again to save you scrolling right back up! (I also made a YouTube video about the online interview which focuses on individuals, but also mentions applying as a company. In both cases the W8 form is generated on your screen and in the case of companies it’s called a W 8BEN-E.

Here is the YouTube video on the KDP interview — it’s worth watching it all the way through and even though it starts off talking about individuals I include screenshots about companies and EINs

Here is a copy of the blog post from much higher up the page:

[START OF EXCERPT] When making a claim you no longer need to obtain a US tax ID (ITIN or EIN). Instead you can now supply your own country’s tax ID. And, as far as I can see, this applies whether you are self-publishing as an individual (which includes sole traders) or through a company – however see below that I recommend you double check this if you’re a company.

To make your claim using Amazon, you complete an online tax interview with CreateSpace and/or KDP – and just follow the online instructions – nice and simple. The questions that appear vary very slightly depending whether you’re applying as an individual or a company – and the final output form that you sign online has a different number for each scenario. Most people reading this will be applying as individuals (includes sole traders). But be sure to check and take a screenshot of what rate of witholding tax will be applied – see my note 24 March below for why.

For other retailers and distributors, at the time of writing you need to download and complete form W8-BEN for individuals (includes sole traders) or form W8-BEN-E if you’re a company/entity. You send this completed form to the retailer/distributor – not the IRS –by post. I provide links to these forms below. [END OF EXCERPT]

Scroll back up to see the full detail.

Many thanks for your comments, Clare (and no problem about mentioning your service!). Margaret, it really sounds to me as if they have got the wrong end of the stick. If you have accidentally registered for US tax I’d probably try to call back to get that rectified. And in any event, I’m not certain you even need to use an EIN any more in the KDP tax interview – I think you could probably enter your Corporation Tax number (in the same way that individuals can now enter their personal Tax Reference or NI number), however I couldn’t get a straight answer on this from anyone. Why not call them back and say ‘I’ve been told that I’ve accidentally registered for US tax when I don’t need to’ or something. It sounds as if the person you spoke to had the wrong end of the stick or was simply misinformed? I would look at what Clare says above again and call them with that info.Good luck! K

Hi Everyone I have just gained my EIN number today – quite painless. However they informed me as a co director of a Ltd Company that I was in their terms a partnership. They told me I had to fill in a 1065 next year. However I downloaded it and it is the MOST complicated 5 page document wanting to know the answers to 22 questions to totally irrelevant questions. Anyone completed one of these? I am going to have to sell a huge number of little kids books to justify an accountant’s time to fill in what may be a zero declaration. Someone back along talked about the 1065 form but no-one replied! Thanks for this page it has been invaluable.

I’ve not had to complete one of these, Margaret – but then I’m a sole director (not that I remember being asked whether there was more than one director – but it was a long time ago!) . And I’m afraid I don’t know enough about US tax to answer your question! Do you need to run your writing through a company? Why not go the sole trader route and swap if you really think it’s worth it? I only used a company because it was set up already for my writing consultancy. Hopefully someone else who sees this will know more than me! K

Would have been simpler I am sure. But not a lot of people know that in order to sell eBooks to Europe you have to remit VAT in the country of the reader – not the UK. So in order to join MOSS ( to avoid 28 registrations and quarterly returns) you have to be VAT registered in the U.K. My reading scheme in 9 languages and not all of them are supported by Amazon. As ever you find a solution to one problem and crash into another one which is why I decided to publish on Amazon and iBooks latterly. Someone will have completed a 1065 by now I am sure, I have a year to find out so no rush. Thank you for all your help.

If you’re selling via a third party such as Amazon, iBooks etc I don’t think that VAT side of things is down to you – they handle it all and it’s part of their reporting. However from what you say I assume you’re selling directly from your site using an automated system? And if that’s what you’re doing then, yes, I think it gets complicated on the VAT side of things!

Hi Karen/Margaret..I’m a UK accountant who also did a lot of research into VATMOSS when it first came in. One of the main pieces of info I tell people applying for an EIN – if they’re a UK company, doesn’t matter how many directors – is that you need to stress to the IRS when you phone them that you are *not* applying to be registered for US tax, but that you want the EIN *only* for the purposes of tax exemption. Then it doesn’t matter what kind of organisation you are under their categories, and you shouldn’t have to report anything to the US at all. Might this be your situation?

Oh dear – I told them exactly what I wanted it for and they were quite clear. Guess I just need to fill in a blank form every year then. It was obvious I am British with a British address and a British Company. I told them it was just me and my partner and we had only just retired. Mrs Stevenson who also raced through a number of my zeros stated I needed to fill in the form and if I gave the actual date of corporation I would need to send forms in back to 2013. Gosh what a mess . Thanks for advice though.

It may be worth another Transatlantic call. I accidentally IRS-registered a company once – when I was only after an EIN for tax exemption – and when I received a huge batch of scary IRS forms in the post, I rang back, clarified it again,and (some weeks later) they sent me a confirmation that I didn’t need to complete IRS returns. It’s very easy to get an EIN, but I have found that the phone operators vary in how helpful and knowledgeable they are. The 1065 is relevant ONLY if you have US income, for trade situated in the US, and you’re wholly UK, as far as I understand. And a corporation, not a partnership. NOTE: if the IRS categorise you as “corporation” or “partnership”, on their system, they’re judging you as like those organisations in the US, not the UK. I’ve found it’s often better to classify a UK company as “other”. Otherwise “corporation” = “US corporation” automatically, and the tax system kicks into action.

I phoned them again and I need a W8- ( one of 59 varieties) then I am sorted. This is now the correct procedure. I will let you know from Death Row if it all goes pear-shaped!

Me again, on the VAT issue :). And yes, VATMOSS is horrible! As Karen says, if you sell entirely through an online distributor like Amazon, they handle the VAT issue directly, and you don’t need to register. But if you sell directly to an end customer yourself through an automated shopping cart, you need to register, whatever the size of your business. But you can register for VAT as a sole trader, you don;t have to be a limited company. And also, if you only sell a few items directly, you can maybe avoid VATMOSS if you change your process to a more manual one (e.g. if you send the ebook attached to an individual email), making it a 2-step process, (i) ordering and (ii) supply. Tricky and annoying I know, but it’s an option some small ebook presses have taken.Hope some of this info helps.Contact me at quidsandquills.com if you want to know more, I have a “One Free Query” email option,, I don;t want Karen to think I’m trying to pimp myself on her excellent blog :)..

Hi Karen,

thanks you for all the great info here.

I am preparing my first eBook and I want to avoid this US tax withholding. After reading that I can use my UK NI number to register for 0% I was very happy. I am a British ciziten although I haven’t lived in the UK for 15 years, I live in an EU country which has no tax agreement with the US. I have a UK bank account, with an accompanying Paypal account, but I don’t have a registered UK address. So, my question is when registering for 0% tax status with Amazan et al. do I need to provide a UK address along with my UK NI number?

Thanks for any help or advice. Martin.

Hi Martin

Honest answer is I don’t know but I suspect you should really register from the country where you pay tax. If you’re not resident here for tax then logic would suggest you need to follow the rules for the country where you are and if they have no tax treat with the US it’s likely you will have withholding tax deducted. As I type I can’t recall if you have to provide your U.K. address (certainly I did as a company) but if you do then I don’t see how it will work for you. If in doubt contact HMRC to ask! Best of luck. K

Dear Karen,

I’d like to start firstly by thanking you for all this time, it has taken you to help so many people, and hopefully help me too.

I have a small (only myself) Ltd based in the UK, which I have used to publish my first book. UK ltd is the equivalent (when for one employee) to be classified in the US as a Disregarded Entity.

I have both my UK’s UTR and US’ EIN. Once I have chosen to say that I am a Disregarded Entity and provided both UTRS, I come to the following option during the KDP tax interview:

CHAPTER 3 – INTERMEDIARY STATUS. Then I have the following options:

1.Nonqualified intermediary

2.Nonwithholding Foreign Grantor Trust

3.Nonwithholding Foreign Partnership

4.Nonwithholding Foreign Simple Trust

5.Qualified Intermediary

6.Territory Financial Institution

7.U.S. Branch

8.Withholding Foreign Partnership

9.Withholding Foreign Trust

This is when my nightmare begins. If you could help with it, I will be more than grateful, but obliged to you. if you could refer me to someone I am willing to pay for consultancy to anyone, only to get this arranged.

I very positively look forward to hearing from you

Kindest regards,

George

Hi George — I’m really sorry that I missed your comment in June but I’m replying anyway. I am struggling to remember this question in the KDP interview which makes me think you must have ticked the wrong option somewhere? From recollection, you simply self-identify as a foreign Corporation and then when they ask for your foreign tax ID enter your EIN if you have that and if you don’t have one then your CT number. It may be that by entering two Tax IDs it is confusing matters? I don’t remember anything about disregarded entities or any of these options you’ve posted above. This video link may be of help — it’s mainly aimed at individuals but I do talk about companies at around 10 minutes in. Sorry I can’t be of more help! https://www.youtube.com/watch?v=p9SlScQc7wI And for the late reply.

As a UK Amazon Kindle book author, I have a question for you: when I first started selling my books on Amazon just over 3 years ago, American tax was regularly deducted from my earnings, as at that time I was unaware that I could apply to be exempt from this as a UK based author. What I’d like to know is, can I go back as far as 3 years to claim back this couple of hundred tax amount they took? If so, is there a particular form I have to download for this?

Hi Alan — apologies for the delayed reply, I’ve been at schools all week as part of World Book Day celebrations so just catching up. I think it is possible to go back and claim some of the royalties but I’m not sure how far back, nor of the process – but 12 months may be the cut off time (or I may have imagined that!). Given that it’s a couple of hundred dollars it sounds worth doing though. I think your best bet would be to call the IRS using the number in my blog post and ask what you need to do. (Call early in their day to save hanging on — I think it’s around 11am UK time but see the post above…) Sorry I can’t be of more help and best of luck! Karen

Hi Karen,

Thanks for the amazing article! I have been a KDP publisher since 2012 and have only just completed the Tax Interview today after seeing your post. This changed my US tax withholdings from 30% to 0% as I entered in my NI number. I was wondering if there was a way to claim the previous years tax withholdings back.

Thanks

Mustafa

Hi Mustafa — I’m not sure if there’s a deadline. Why not email CreateSpace and ask them or try googling it? I think I heard that it’s more trouble than it’s worth – but it will depend how much you’re owed!

Karen.

A big thanks you for putting all this great information together. I have a quick tax question. I have published a book via CreateSpace and completed the relevant registration forms so that no US tax is withheld. Most of my books have sold on Amazon.com in US dollars (but are paid via bank transfer in GBP). I know that the royalties will have to go on my self assessment return. Do I have to list these US royalties separately as foreign income? Or do I just add the amount in GBP to my overall total for the year? I know that you’re not an accountant but any advice would be appreciated. Many thanks in advance.

Chris

Hi Chris – I checked with my accountant and here’s what he said (I couldn’t remember as I run my books through my company at the moment…)

If no tax has been deducted I wouldn’t bother with foreign income pages, simply include it with self employed income.

He also says: (but this isn’t relevant to you as no tax was deducted)

[Basically If you have foreign self employed income you include it all within the self employed pages and then detail the amount subjected to foreign tax and the amount of tax deducted so that the appropriate relief can be given for that tax if applicable.

It does have to be included as UK residents are taxed on worldwide income.]

Many thanks for your quick reply. That’s just what I needed to know. Your blog has been a great help once again. Cheers.

Many thanks – glad to have been of help 🙂

Great information. I have a stupid question though. I’m in the UK and the wage from my day job puts me into the 40% tax bracket. Would it make sense to me to let Amazon take the 30% out of royalties and tell HMRC in this country that I’ve already paid tax on the royalties? Or will this be frowned upon? Maybe tax treaties are meant to work both directions (so UK HMRC doesn’t lose out on tax from UK authors?)

Hi Anthony (hijacking Karen’s post again *g*). Not a stupid Q at all, but no, you still have to declare your royalties to HMRC as UK income for a UK resident and – unfortunately – have them taxed at 40%. But you can then deduct the withheld tax from your tax bill. The pre-deducted tax is like an instalment already paid, rather than a full tax liability. Make sense? (well, my explanation, not necessarily the Uk tax laws! *g*).

Hi Karen, I have submitted my Uk Tax Identification number but after I had received tax information saying they had withheld a rather large amount of money. How can I get that release to me or will they automatically release it now I have updated my Tax ID number?.

Hi Mark — I’m not sure though I have seen this discussed. I’ve just asked a couple of people who may know and will leave a message later. I think there’s a deadline btw. In the meantime I would suggest googling the Kindle forums etc or even trying to call the IRS helpline. K

Mark, I’m a UK accountant and have looked into this in the past, for my clients. I’m looking for the legislation reference to back it up, and I’ll post it here when I find it, but I believe you can’t get the actual withheld money back without filing a US tax return.

*Please check with a US accountant if you need to make sure!*

I’ve also been told by US publishers in the past that once they’ve paid that withheld tax to the IRS, they can’t get it back for you. So if they *did* offer to repay you, it’d be from their own funds – though presumably they could sort that out in their annual tax return overall? but I confess I don’t know enough about how it works with the IRS. Suffice to say, the US publishers I’ve talked to say they can’t do it, period.

For background: Most UK authors obtain an ITIN and/or submit to places like Amazon with their UK tax number on the understanding that it’s ONLY so they can benefit from the tax treaty and therefore have no tax deducted in the first place. i.e. it doesn’t enter you for any other US tax status, NOR do you have to make USA federal tax returns like all US citizens. However, the other side of that coin means you’re not really IN the US tax system and therefore can’t use their system to reclaim any pre-deducted tax.

Your only other option is to deduct it from your UK tax bill at the end of the tax year, when you report to HMRC. You can deduct any US deducted tax – in the same way you deduct any PAYE suffered at your job – from the amount that you owe i.e. they recognise that you’ve already paid towards your royalty income, albeit in another country.

Tricky, but I think that’s true. I’m very happy to have it confirmed or challenged by anyone who’s actually tried to get the money back! 🙂

And having read through again – Nola (above, Aug 26 2015) confirms you’d need an ITIN to reclaim tax in cash terms.

Hi again Mark and also thanks to Clare for your input. Very sorry for my delayed feedback but we were away for a few days and up to my eyes before that. Below is the reply I got from someone called Chrissie at the Alliance of Independent Authors – I’m not sure if this chimes with Clare’s advice but I think the bottom line is to call the IRS on the number below as they sound very helpful, even if the process will take time! Do let us know how you got on in case and I’ll add tips for anyone else. Karen

I went to the US Embassy in London to do mine, but their IRS Dept has now closed. Now you can do it all online via their website or phone. If you have paid tax you should be sent a 1042 S form which sets out the company that the tax was withheld through and the tax year the money was withheld in. I would suggest contacting the IRS, normally you would complete a 1040NR (US Nonresident Alien income Tax return form, and a W-8BEN (Certificate of foreign status of beneficial owner for US Tax withholding and reporting – individual form), these form declare your status as a UK citizen exempt form paying tax. But if you call the IRS they will talk you through all the necessary steps to claiming your refunds. They are extremely helpful and pleasant to deal with on the phone. The link is https://www.irs.gov/individuals/international-taxpayers/u-s-citizens-and-resident-aliens-abroad [now corrected] Just so that you are aware, any tax deducted at source from international citizens (non-US) is now held in withholding for money laundering and fraud checks. The withholding checks take 12-18months and once they are done, you then receive the money in USD (with added interest) via cheque to your home address. Bear in mind the checks start at the close of the US financial year end. So for instance my 2015 withheld won’t be returned to me until l2017. It is a bit of a pain, BUT, as far as I’m concerned, as a UK citizen I am exempt from paying US tax, so the money is mine and I would like it back and will do what I can to see it returned. Contact details for philidelphia office IRS is 001 267 941-1000 – the office is open Monday through Friday from 6:00 a.m. to 11:00 p.m. EST. I hope this goes some way to helping. Let me know if you have any questions.

Oops – that link above didn’t fully go in — here it is again >> https://www.irs.gov/individuals/international-taxpayers/u-s-citizens-and-resident-aliens-abroad

That’s really useful, thanks!

Hi Karen, just wanted to say a massive thank you for this article. Trying to research this was proving a massive headache until I found it. Five minutes later and the form is complete 🙂 Cheers, Craig.

Thanks for the information and tips shared! I found it really informative and helpful. Getting an EIN is important for business owners and anyone who want to apply for it can directly apply on the IRS website. Otherwise, contacting the real experts will be more helpful to complete the process in a short time.

I had published a book in USA. I had asking 15%-Royalty tax and 15%-Withholding tax on royalty inncome.

Let me know whether it is correct.

Hello Dr Patel – what country are you based in? That will determine what the withholding tax should be. Karen

Pingback: Indelibles, Shareathon, #Row80 News Updates & Resources. #amwriting | Shah Wharton

Thank you for putting it all so clearly. (I do hope the publlishers commission you to rewrite their taxation-for-foreigners documents and procedures!)

Ha ha! Thanks 🙂

Hi Karen

I’m so pleased to see that the whole process has been made a bit easier than it was. I don’t really earn enough yet to be paying tax here in the UK, however will probably need to pay NI contributions now that my National INsurance number has been sent to the Tax people to say I’m a self-employed author.

Once this has all been Ok’d by the US and verified can you apply to have the money that has been withheld in US, (your royalties) returned to you in a cheque or bak transfer? And if so, when and how far back can you claim?

Many thanks

I am a new writer who is about to publish an ebook on Amazon. I’m from a country without a tax treaty with the US. Does it still make sense for me to apply for an EIN given that even if I do so I will be taxed at the non-treaty rate which is also 30%?

Given that both with or without an EIN, my tax rate is still 30%. Therefore, I am thinking the only reason for me to apply for an EIN is to fulfill some tax requirement and avoid IRS penalizing me in the future.

Short version: Does it make sense for a writer/publisher from a country without a tax treaty with the US to apply for an EIN?

Hi Chris

Off the top of my head I would say there is no point as the only reason to apply is to get the tax back. However why not google the question and include your country’s name and see if anyone else has asked this? You may see answers/questions from people in other sorts of business where this has been answered. And/or ask a friendly local accountant! Or you could call your own tax office (equivalent of the IRS) in your country and ask them? Hope this helps!

Karen